The mantra “The dollar is king” echoes in all currencies as the yen falls

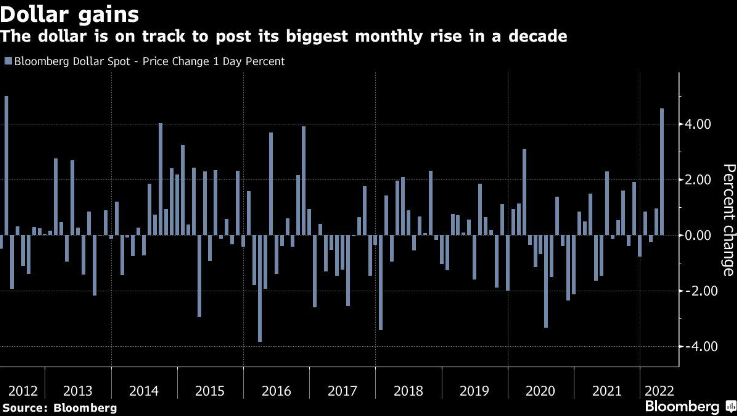

(Bloomberg) – The rising US dollar headed for its best month in a decade as renewed yen selling cemented the greenback’s strength against its major peers.

Bloomberg’s Most Read

A Bloomberg indicator of the greenback hit its highest level in nearly two years and rose 4.5% this month, set for its best performance since May 2012. The dollar extended its gains against the yen, hitting a two-decade high, after the Bank of Japan kept interest rates low and defended its accommodative monetary policy. This contrasts with a Federal Reserve that signaled aggressive rate hikes to fight inflation.

“It’s clearly a world where the US dollar is king,” said Mingze Wu, Singapore forex trader at StoneX Group. “The dollar will continue to strengthen globally as long as the rest of the world does not follow interest rate hikes.”

The US currency posted large gains against its Group of 10 counterparts this week, hitting a five-year high against the euro and the highest level since July 2020 against the pound, ahead of the meeting of the Fed next week. Policymakers are expected to raise rates by 50 basis points, following a quarter-point hike in March.

Widening interest rate differentials between the United States and other countries, as well as the risks of a global recession and war in Ukraine are bolstering sentiment on the dollar, Wu said.

Free fall of the yen

The Bloomberg Spot Dollar Index climbed to 1,250.01 on Thursday and was up 0.4% at 10:23 a.m. London. The dollar gained 0.3% to $1.0529 per euro and extended its advance to 2% against the yen.

The US currency was partly supported by its Japanese counterpart, which has been in freefall this year. The BOJ said it would make purchases of fixed-rate bonds every business day as part of its stimulus measures. As expected, it kept its yield curve control parameters and the scale of its asset purchases unchanged, according to a statement on Thursday.

As consumer prices in Japan also rise due to rising import costs, the central bank said it would not change policy until inflation was stable above its target by 2%.

Japanese government bonds rallied on the BOJ decision, with the 10-year yield falling 2.5 basis points to 0.215%. The 30-year rate fell 1.5 basis points to 0.96%. The spread between Japanese and US 10-year bond yields widened to its maximum in three years.

A growing trade deficit has also caused more yen to flow out of the country to pay for dollar-priced goods. Divergence in yields and trade offset efforts by government officials to limit the currency’s slide.

The market’s focus on rate differentials was highlighted on Thursday by the Swedish krona’s jump after a surprise quarter-point rate hike from the central bank, which signaled that it could make up to three more increases in 2022.

In Asia, the Korean won and the Chinese yuan came under pressure, with the latter losing more than 1% in offshore trading.

“The selling incentive is so strong that it’s impacting other currencies via buying dollars,” said Daisuke Karakama, chief market economist at Mizuho Bank in Tokyo.

(Updated prices in the second paragraph and in the “Yen Freefall” section.)

Bloomberg Businessweek’s Most Read

©2022 Bloomberg LP